do nonprofits pay taxes on rental income

Do nonprofit organizations have to pay taxes. But if you rent out a property for only 14 days or fewer out.

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Just because you have a tax-exempt status it does not mean that.

. Its worth noting though that not everyones personal allowance will be the same as it can. When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a severe loss of tax. Your recognition as a 501 c 3 organization exempts you from federal income tax.

Report rental income on your return for the year you. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. But determining what are an.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. This method requires you to report income as you receive it and expenses as you pay them out. In general those who rent out a property for 15 days or more out of the year must pay taxes on rental income.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. But some businesses use the accrual method of accounting. However this corporate status does not.

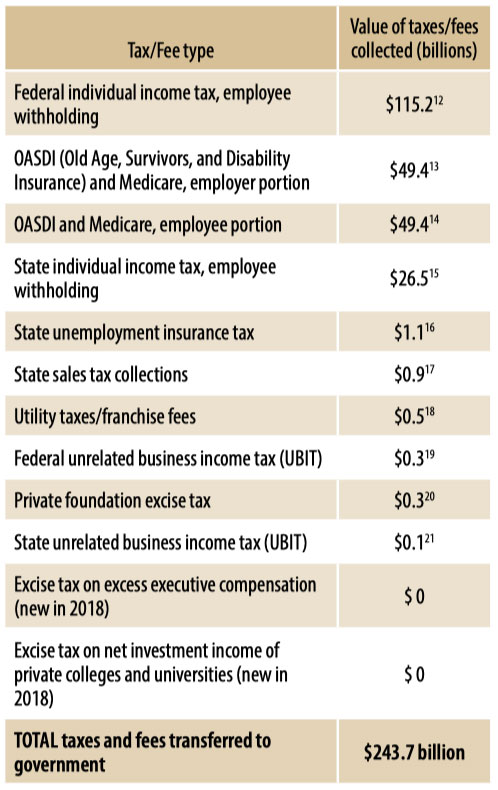

The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items.

Rent from net profits leases. But nonprofits still have to. However here are some factors to consider.

Most nonprofits do not have to pay federal or state income taxes. While most US. Where the rental income is based on a percentage of the lessees sales or profits the rental income will not qualify for exclusion.

Yes nonprofits must pay federal and state payroll taxes. June 30 2021. Did you know that sometimes nonprofits must pay income tax.

Taxable if Income from any item given in exchange for a donation that costs the.

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Vacation Home Rentals And The Tcja Journal Of Accountancy

Correcting Public Charity Misconceptions Rent

/PassiveIncomeV2-655c2a09951a493ebaf3ce2d6df3ad0a.png)

Passive Income What It Is 3 Main Categories And Examples

Company Tax Breaks For Nonprofit Donations

Publication 527 2020 Residential Rental Property Internal Revenue Service

University Neighborhood Housing Program

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

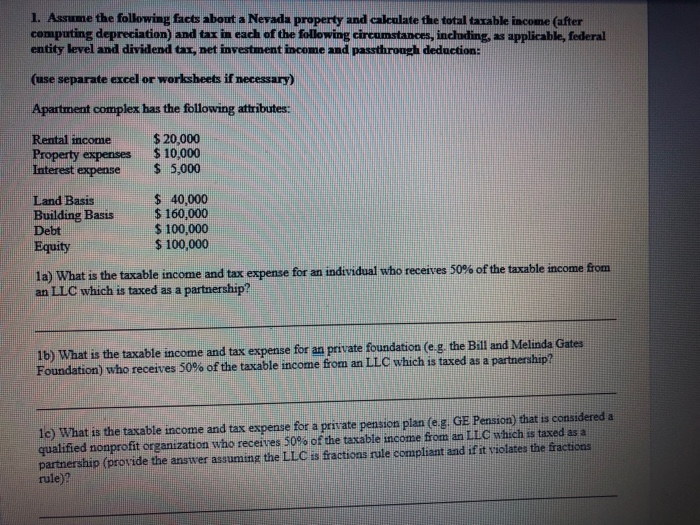

1 Assume The Following Facts About A Nevada Property Chegg Com

How Regular People Can Pay Less Taxes Like The Rich And Powerful

How The Irs Defines Charitable Purpose Foundation Group

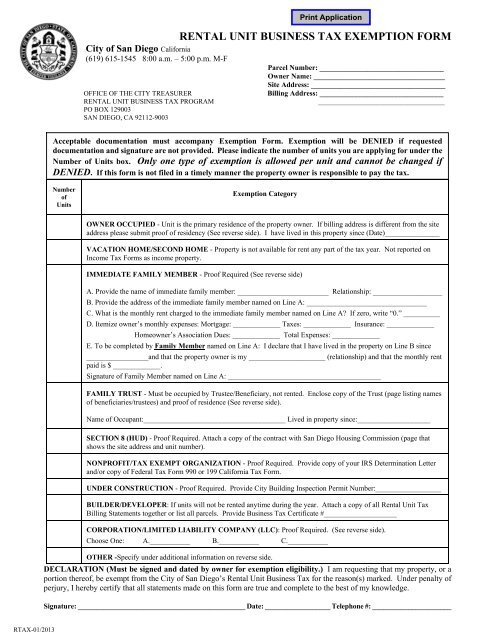

Rental Unit Business Tax Exemption Form City Of San Diego

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Rental Income And Ubti A Look At The Irs Guidance To Its Auditors

How The Irs Defines Charitable Purpose Foundation Group

Ubti Reporting Requirements For Partnerships And S Corporations

Unrelated Business Income Tax Information For Charities Other Nonpr